Now Reading: Finance and Accounting 101: Key Concepts for Beginners

-

01

Finance and Accounting 101: Key Concepts for Beginners

Finance and Accounting 101: Key Concepts for Beginners

Finance and Accounting 101: Key Concepts for Beginners

Did you know small businesses often ignore finance and accounting until it’s too late? Many think managing money is easy, but it’s much more complex. This article will teach you the basics of finance and accounting to help beginners.

Key Takeaways

- Financial literacy shapes business decisions and growth potential.

- Finance and accounting work together to track income, expenses, and profitability.

- Mastering core terms like revenue, equity, and cash flow builds confidence in financial services.

- Common mistakes in budgeting and cash flow management can be avoided with foundational knowledge.

- Understanding these concepts reduces risks and improves decision-making for startups and small businesses.

This guide explains how finance and accounting are crucial for every successful business. It covers budgeting, cash flow analysis, and key terms. Learn how to apply these principles to real-world scenarios and align them with your business goals.

Introduction to Finance and Accounting

Finance and accounting are key to a business’s success. They help make smart choices and keep track of money. Let’s see how they shape business plans and results.

Why Financial Literacy Matters in Business

Knowing finance helps businesses handle risks and chances. Without it, even simple choices can go wrong. For example, financial planning makes sure money is used wisely. A retail startup might use QuickBooks to manage cash flow and avoid mistakes.

“Numbers never lie. Financial literacy turns those numbers into actionable insights.”

The Relationship Between Finance and Accounting

Finance deals with big decisions, like growing the business or investing. Accounting, on the other hand, handles daily money matters and reports like profit/loss statements. Together, they give a complete view. A restaurant owner might use accounting data to adjust menu prices and control costs.

Core Skills for Financial Success

- Attention to detail: Spotting mistakes in financial reports is crucial.

- Strategic thinking: Good financial planning means thinking ahead about needs and risks.

- Technical proficiency: Using tools like Excel and investment software makes work easier.

Learning these skills is the first step to growing. Whether it’s analyzing markets or balancing accounts, these abilities help businesses succeed.

The Fundamentals of Budgeting

Budgeting is key to a business’s financial health. It turns dreams into real plans, making sure money goes where it should. To budget well, you need to know your income, expenses, and what’s most important. Let’s look at how to make, change, and avoid mistakes in budgeting.

Creating an Effective Business Budget

First, set clear financial goals. Track your income and expenses for a month to see patterns. Then, use this info to plan how to spend your money wisely. A good budget includes:

- Fixed costs (rent, salaries)

- Variable costs (supplies, marketing)

- An emergency fund (5-10% of your total)

“The team stayed within the budget for the event by forecasting every detail.”

Different Types of Budgets

- Operating budgets: Daily income and expenses (like payroll and utilities).

- Cash budgets: For short-term money needs.

- Capital budgets: For big investments, like buying equipment.

- Zero-based budgets: Every dollar has a purpose, no assumptions.

Common Budgeting Mistakes to Avoid

Many businesses fail because of simple mistakes like:

- Not accounting for inflation or seasonal changes

- Setting too high revenue goals

- Not reviewing and updating budgets regularly

Regular checks keep your budget on track with market changes. Tools like QuickBooks or Excel help you stay on top of your finances.

Understanding Cash Flow Management

Cash flow management is key to a business’s survival. It ensures money coming in is more than money going out. This keeps the business running smoothly. In finance and accounting, tracking cash flow helps avoid money problems. Even profitable businesses can run into cash issues if payments are late or expenses rise suddenly.

Effective financial planning starts with watching cash flow closely in real-time.

Profit and cash flow are not always the same. A company might look profitable on paper but struggle with cash due to late payments. For example, a service business with $500k in annual revenue might still face monthly cash shortages if payments take 60 days. Cash flow analysis helps show a company’s true financial health.

- Track daily transactions using accounting software like QuickBooks or Xero.

- Forecast cash flow weekly to identify potential shortfalls early.

- Shorten customer payment terms to 15 days instead of 30.

- Renegotiate supplier terms for extended payment deadlines.

- Build a 3-6 month emergency cash reserve.

Inventory management also matters. Too much inventory can tie up cash in unsold goods. Using just-in-time systems can cut inventory costs and boost cash reserves. Clear payment policies, like offering 2% discounts for early payments, can also speed up cash coming in without hurting profit margins. By using these strategies, businesses can keep their cash flow stable and fund growth without risking bankruptcy.

Essential Finance and Accounting Terminology

Learning finance and accounting begins with key terms. This glossary simplifies complex concepts. It helps in making better decisions and improving bookkeeping.

Balance Sheets and Income Statements

A balance sheet lists a company’s assets, liabilities, and equity at a certain time. The income statement shows revenue, expenses, and profit over time. Both are crucial for understanding a company’s financial health.

Assets, Liabilities, and Equity

- Assets: Things a business owns, like cash or equipment.

- Liabilities: Debts or things a business owes, like loans.

- Equity: What a business is worth after subtracting liabilities from assets.

Revenue vs. Profit

Revenue is all income before costs. Profit is what’s left after subtracting expenses. For instance, a bakery might make $10,000 in sales and spend $6,000 on costs. This leaves a net profit of $4,000.

“Revenue builds the top line; profit reveals the bottom line.”

Terms like gross profit (revenue minus direct costs) and net profit (final earnings after all expenses) help understand financial performance. Good bookkeeping is key to tracking these figures. It aids in planning and talking to stakeholders.

Building a Profitable Business Model

Profitable businesses succeed by matching strategy with clear goals. Financial services and investment analysis are key to finding ways to increase profits and grow. Let’s look at steps to improve your strategy.

Key Metrics for Measuring Profitability

Keep an eye on these numbers to see how well your business is doing and how it might grow:

| Metric | Definition |

|---|---|

| Gross Profit Margin | Revenue minus cost of goods sold, showing production efficiency. |

| Net Profit Margin | Profit after all expenses, reflecting overall financial health. |

| ROI | Measures returns relative to investment costs. |

| Break-even Analysis | Calculates when revenue equals expenses, signaling viability. |

Strategies to Improve Profit Margins

- Pricing optimization: Adjust pricing based on cost structures and market demand.

- Cost control: Reduce overhead through automation and supplier negotiations.

- Value-added services: Offer premium tiers to increase customer lifetime value.

Financial services often use investment analysis tools to find cost savings and new revenue. For example, cloud-based accounting software helps track finances automatically. This frees up time for making important decisions.

Case Studies: Successful Profit Optimization

A Midwest bakery increased its margins by 22% with dynamic pricing software. They adjusted prices during busy times and cut food waste with inventory analytics.

Another example: A tech startup worked with financial advisors to improve its supply chain. This cut operational costs by 18%. Such moves show how investment analysis can help businesses grow.

Financial Planning and Analysis

Effective financial planning starts with strong analysis. FP&A teams use past data and market trends to make forecasts. They also evaluate risks and plan budgets. Tools like financial modeling and scenario analysis help businesses adjust to changes.

- Financial forecasting: Projects revenue, expenses, and cash flow for upcoming periods.

- Scenario planning: Tests how different economic or operational changes affect outcomes.

- Variance analysis: Compares actual results to forecasts to identify performance gaps.

Data accuracy is key. Regular auditing checks if financial statements show the real business health. Cloud-based software like QuickBooks or Excel makes this easier. It allows for quick data updates and teamwork.

Startups should start with simple forecasts and add more tools as they grow. Small businesses can work with consultants to improve their FP&A plans. Combining financial planning with auditing helps make better decisions and use resources wisely.

By matching forecasts with auditing results, companies can avoid overestimating profits or underestimating risks. This balance helps businesses grow sustainably and work more efficiently at every stage.

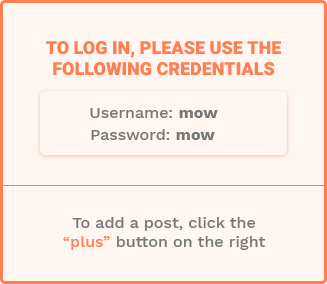

Accounting Systems and Software for Beginners

Choosing the right accounting system makes tracking finances easier. For small businesses, finding a balance between accuracy and efficiency is key. This means understanding both old and new tools.

Manual vs. Digital Bookkeeping

Manual bookkeeping uses paper or spreadsheets, great for small operations. Digital systems, on the other hand, automate entries and cut down on errors. They also connect with tools for managing payroll. This helps businesses grow faster.

Popular Accounting Software Solutions

Platforms like QuickBooks, Xero, and FreshBooks offer invoicing and expense tracking. They also provide real-time reports. QuickBooks is strong in payroll for US employers, while Xero is good for cloud collaboration. Look at pricing and how well it scales before making a choice.

Setting Up Your First Accounting System

- Create a chart of accounts to organize transactions.

- Link bank accounts for automatic imports.

- Set up tax rates and deductions for accurate payroll.

- Train staff on the software to keep things consistent.

“Automation cuts manual work, but proper setup ensures long-term success.”

Using software with regular audits helps avoid mistakes. Start with the basics and add more as your business grows. Always choose a provider that values security and customer support.

Tax Considerations for Small Businesses

Small business owners face many tax challenges. They must prepare for taxes and audits to save money and follow the law. The type of business you have affects your taxes. Sole proprietors report income on their personal tax returns. Corporations, on the other hand, are taxed twice.

LLCs and partnerships have pass-through taxation. This means they don’t pay taxes on the business income. But, they need to keep detailed records.

Businesses can deduct many things, like office supplies and employee wages. They can also get credits, like the Small Business Health Care Tax Credit. This can lower what they owe in taxes.

It’s important to keep receipts and invoices for at least three years. This helps make sure your taxes are accurate. If you miss deadlines, like quarterly tax payments, you might face penalties.

“Accurate recordkeeping is the foundation of successful tax preparation,” says IRS guidelines. “Documentation ensures compliance during audits.”

| Business Type | Tax Form | Key Consideration |

|---|---|---|

| Sole Proprietorship | Form 1040 Schedule C | Personal liability for self-employment taxes |

| LLC | Form 1065 or 1120 | Pass-through income options |

| Corporation | Form 1120 | Double taxation potential |

Businesses need to plan their cash flow for quarterly payments and annual filings. If your records are not consistent, you might face more audits. It’s wise to schedule annual tax reviews with a CPA. This helps keep your taxes in line with your business goals.

Conclusion: Mastering Finance and Accounting for Business Success

Mastering finance and accounting helps businesses grow in changing markets. It teaches how to turn financial problems into chances. By using these tips, entrepreneurs can make their finances work with their goals, making their business strong and able to grow.

Keeping up with financial services and tools is key for growth. Using tools like QuickBooks or Xero makes tracking easier. Getting certifications like CPA or CMA boosts your skills. These steps help leaders make smart choices based on data, improving profits and stability.

Markets and trends change all the time, so it’s important to update your financial plans. Being financially smart brings clarity and confidence. Businesses that focus on these areas are ready to face challenges and seize new chances, ensuring they stay strong over time.

FAQ

Q: What is the difference between finance and accounting?

A: Finance deals with managing money and investments. It’s about making financial plans. Accounting, on the other hand, focuses on recording and analyzing financial data. Knowing both is key for good financial management.

Q: Why is budgeting important for businesses?

A: Budgeting helps businesses plan how to spend money. It ensures resources are used wisely. This planning supports growth and keeps the business stable.

Q: How can I improve my company’s cash flow management?

A: To better manage cash flow, negotiate good payment terms with suppliers. Offer incentives for early payments from customers. Keep a close eye on money coming in and going out. Also, have enough cash on hand.

Q: What key financial statements should I understand?

A: You should know the balance sheet, income statement, and cash flow statement. The balance sheet shows what your company owns, owes, and its value. The income statement tracks income and expenses. The cash flow statement shows money coming in and out.

Q: What are common budgeting mistakes that businesses should avoid?

A: Avoid underestimating costs and overestimating income. Don’t forget to update budgets regularly. Also, make sure everyone involved in budgeting is on board.

Q: How can financial planning and analysis (FP&A) benefit my business?

A: FP&A connects past data with future plans. It helps in strategic planning and resource allocation. This leads to growth and helps spot challenges early.

Q: What types of accounting systems are available for small businesses?

A: Small businesses can choose manual bookkeeping or digital accounting software. Digital systems make tasks like payroll and financial reports easier. They improve efficiency.

Q: What tax considerations should small business owners be aware of?

A: Know the tax implications of your business structure. Understand deductions and credits, and what records you need to keep. Also, be aware of filing deadlines to stay compliant and save on taxes.

Q: What are some effective strategies for improving profit margins?

A: Improve profit margins by optimizing prices and controlling costs. Work on making operations more efficient. Adding value-added services can also boost profitability.

Q: How do I know if my business is financially healthy?

A: Check financial health by looking at profitability ratios and cash flow indicators. See how your performance matches budgeted targets. This gives a clear picture of your financial health.